2025 Hunter Region Industrial Market Wrap-up

Newcastle’s industrial sector remained resilient throughout 2025, supported by stable interest rates, population growth and continued investment in major infrastructure such as the M1 extension and Port of Newcastle upgrades. With more than 100 industrial transactions by Commercial Collective alone, and over $220 million in value recorded, the market reflected constrained supply, rising operational needs and consistent demand across established industrial hubs including Beresfield, Cardiff, Rutherford and Hexham.

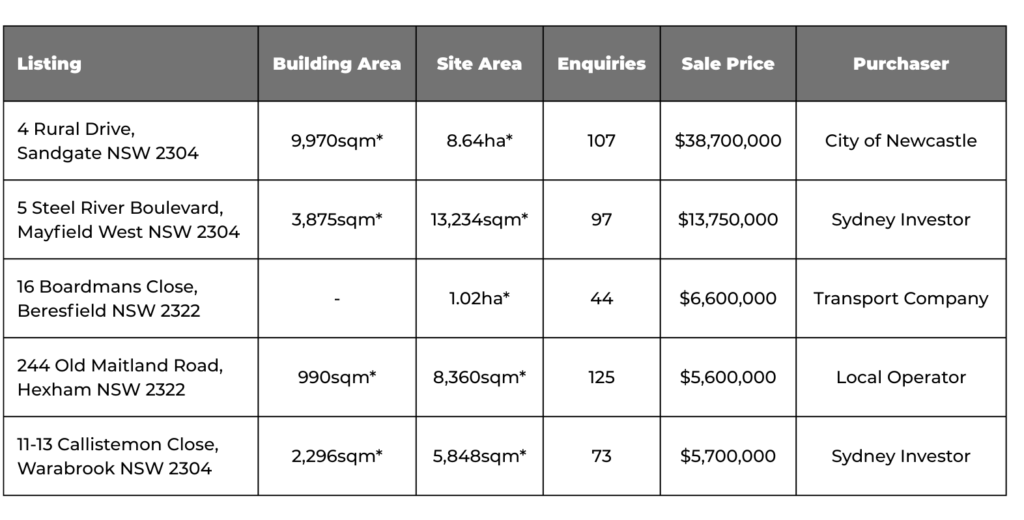

Industrial sale performance

Sales in 2025 were concentrated in core industrial precincts where functional stock and strong transport connections remain limited. Beresfield, Rutherford, Cardiff, Hexham and Warabrook recorded the strongest industrial-style activity, driven by buyers seeking operational flexibility, immediate usability and long-term certainty. These precincts continue to benefit from zoning stability and minimal future land release.

Strategic locations such as Mayfield West and Thornton also delivered important results, despite lower transaction volumes. Mayfield West maintained its status as a tightly held inner-ring precinct, while emerging areas like Black Hill gained momentum due to new development, M1 access and increasing enquiry from operators seeking modern facilities. Overall, purchaser behaviour remained anchored to scarcity, connectivity and the availability of functional assets ready for occupation.

Industrial lease performance

Leasing demand remained broad and competitive, particularly from logistics, manufacturing and trade-related industries. Cardiff, Edgeworth and Beresfield again performed strongly, supported by established industrial ecosystems and proximity to major arterial networks. Medium-format buildings between roughly 1,600sqm and 3,500sqm attracted the highest enquiry as businesses sought to consolidate or upgrade operational footprints in a tight supply environment.

Mayfield West, Beresfield and Rutherford also recorded sustained activity, reflecting their alignment with major industrial clusters and supply chain infrastructure. Enquiry strengthened in emerging precincts such as Black Hill, where new development and highway access appealed to service-based operators and growing SMEs. Tenant decisions throughout the year centred on operational efficiency and immediate availability rather than bespoke configurations.

Industrial Market Outlook for 2026

Looking ahead to 2026, the fundamentals of Newcastle’s industrial market remain stable, supported by continued business growth, infrastructure investment and limited new supply entering the pipeline. Enquiry levels at the close of 2025 indicate that demand for functional, well-located industrial assets is likely to persist across both sales and leasing segments, particularly in precincts with strong transport connections and established industrial ecosystems.

With several larger industrial assets expected to come transacted early in the year, and population and business activity continuing to rise across Greater Newcastle, the region is positioned to maintain its momentum as a preferred industrial destination for investors, developers and occupiers seeking long-term operational certainty. If you are considering an industrial purchase, lease or investment in the year ahead, the team at Commercial Collective can provide clear market insight and support your decision-making. Reach out to us to discuss your plans for 2026.